Page 62 - Mantena Annual report 2019

P. 62

Mantena Group

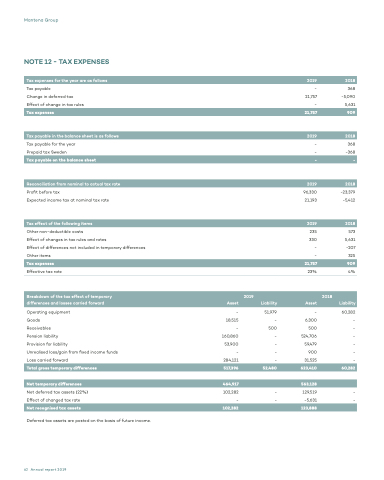

NOTE 12 - TAX EXPENSES

Tax payable

Change in deferred tax Effect of change in tax rules

Tax payable for the year Prepaid tax Sweden

Profit before tax

Expected income tax at nominal tax rate

Other non-deductible costs

Effect of changes in tax rules and rates

Effect of differences not included in temporary differences Other items

Effective tax rate

- 368 21,757 -5,090 - 5,631

- 368 - -368

96,330 -23,379 21,193 -5,412

235 573 330 5,631 - -207 - 325

23% 4%

- 60,282 6,300 - 500 - 524,706 - 59,479 - 900 - 31,525 -

129,519 - -5,631 -

Tax expenses for the year are as follows:

2019

2018

Tax expenses

21,757

909

Tax payable in the balance sheet is as follows

2019

2018

Tax payable on the balance sheet

-

-

Reconciliation from nominal to actual tax rate

2019

2018

Tax effect of the following items

2019

2018

Tax expenses

21,757

909

Breakdown of the tax effect of temporary

2019

2018

differences and losses carried forward

Asset

Liability

Asset

Liability

Operating equipment

Goods 18,515 Receivables -

51,979 -

500 -

-

-

-

-

-

Pension liability

Provision for liability

Unrealised loss/gain from fixed income funds Loss carried forward

Net deferred tax assets (22%) Effect of changed tax rate

Deferred tax assets are posted on the basis of future income.

-

160,860 53,900 - 284,121

102,282 -

Total gross temporary differences

517,396

52,480

623,410

60,282

Net temporary differences

464,917

563,128

Net recognised tax assets

102,282

123,888

62 Annual report 2019