Page 60 - Mantena Annual report 2019

P. 60

Mantena Group

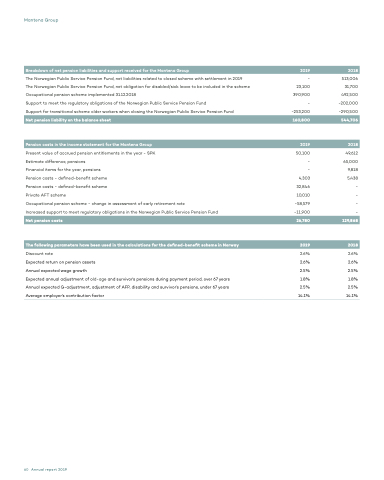

Breakdown of net pension liabilities and support received for the Mantena Group

2019

2018

The Norwegian Public Service Pension Fund, net liabilities related to closed scheme with settlement in 2019 The Norwegian Public Service Pension Fund, net obligation for disabled/sick leave to be included in the scheme Occupational pension scheme implemented 31.12.2018

Support to meet the regulatory obligations of the Norwegian Public Service Pension Fund

Support for transitional scheme older workers when closing the Norwegian Public Service Pension Fund

Present value of accrued pension entitlements in the year - SPK Estimate difference, pensions

Financial items for the year, pensions

Pension costs - defined-benefit scheme

Pension costs - defined-benefit scheme

Private AFT scheme

Occupational pension scheme - change in assessment of early retirement rate

Increased support to meet regulatory obligations in the Norwegian Public Service Pension Fund

Discount rate

Expected return on pension assets

Annual expected wage growth

Expected annual adjustment of old-age and survivor’s pensions during payment period, over 67 years Annual expected G-adjustment, adjustment of AFP, disability and survivor’s pensions, under 67 years Average employer’s contribution factor

-

23,100 390,900 - -253,200

50,100 -

-

4,303 32,846 10,010

-58,579 -11,900

2.6%

2.6% 2.5% 1.8% 2.5%

14.1%

513,006 31,700 492,500 -202,000 -290,500

49,612 65,000 9,818 5,438 - - - -

2.6%

2.6% 2.5% 1.8% 2.5%

14.1%

Net pension liability on the balance sheet

160,800

544,706

Pension costs in the income statement for the Mantena Group

2019

2018

Net pension costs

26,780

129,868

The following parameters have been used in the calculations for the defined-benefit scheme in Norway

2019

2018

60 Annual report 2019